CHICAGO – New documents obtained by Fox 32 show that Gov. J.B. Pritzker’s office was warned by Chicago officials that pension legislation could cause deep financial harm to the city.

Warning before the bill was signed

What we know:

The warning was sent to his office days before Pritzker wound up signing the bill. Critics say it will add billions to the city’s financial problems.

The governor signed the so-called Tier 2 police and fire pension bill in early August, against the recommendations of financial watchdogs like the Civic Federation, who warned that it would add $11 billion to the city’s financial burden over the next 30 years, with no clear way to pay for it.

Pritzker’s defense

When asked why he signed, Pritzker responded that he didn’t know Mayor Brandon Johnson’s position on it.

“The mayor never once called me or, as far as I know, any legislators, to oppose that bill or ask for any changes in that bill,” Pritzker said on Aug. 7 at the Illinois State Fair. “When a municipality is affected by some piece of legislation doesn’t speak up about opposing it, than how can people know they oppose it?”

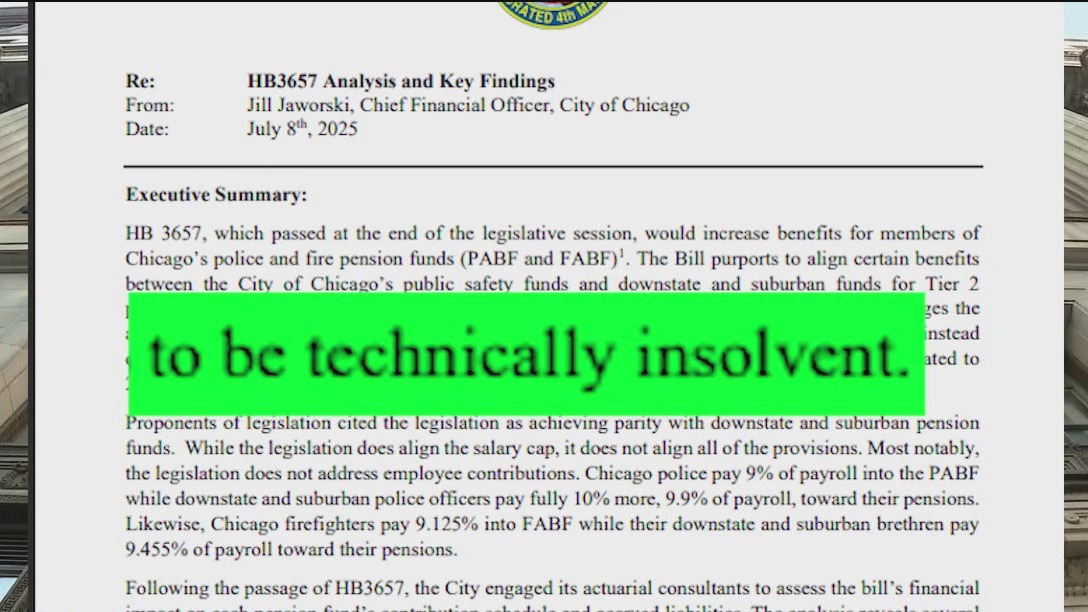

Internal memo reveals concerns

But an internal memo obtained by Fox 32 Chicago shows that the city’s Chief Financial Officer Jill Jaworski warned Andy Manar, a top official in Pritzker’s office, about the financial ramifications of the bill.

“Through 2055, the bill would increase accrued liabilities by $11.1 billion,” for the city police and fire pension funds, the memo states, going on to say that the bill doesn’t offer any way to pay for the new liabilities, and that the debt would push those accounts below 20% funded, or “technically insolvent.”

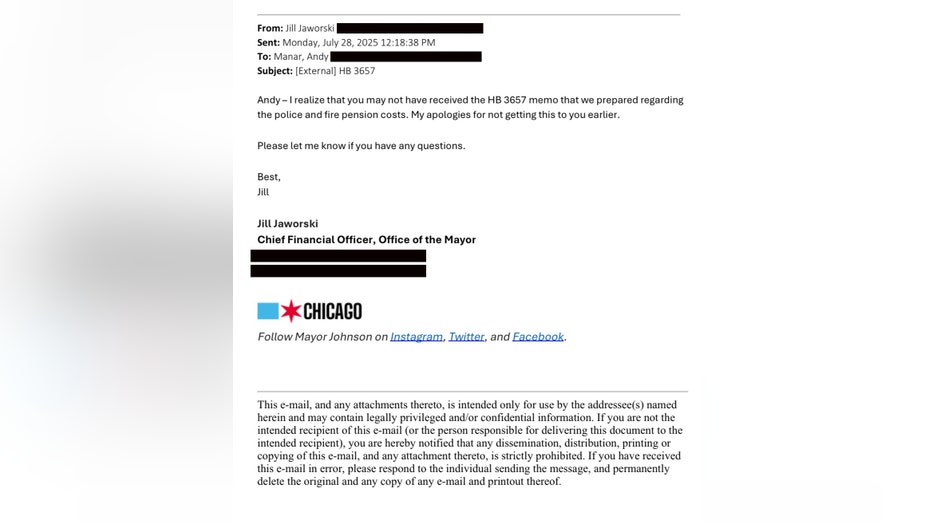

The memo was dated July 8. A follow-up email dated July 28 reveals that Manar failed to receive the initial memo.

“My apologies for not getting this to you earlier,” Jaworski says in the email.

What they’re saying:

Austin Berg, Executive Director of the Chicago Policy Center, an offshoot of the Libertarian-leaning Illinois Policy Institute, says he believes both city and state officials dropped the ball. The mayor’s office for not lobbying more forcefully against it, the governor’s for ignoring the warning signs.

“Springfield is not blameless in this,” Berg says. “But you would think that for a bill that has this impact on only Chicago, that the mayor and the CFO would be on the phone every day talking to state representatives, state senators and the governor’s staff, but instead they were totally missing in action.”

Jaworski also expressed her concerns in testimony before lawmakers in Springfield last spring.

Mayor’s office responds

In a statement, Johnson’s office says the memo: “corroborates what we said all along: that both the legislators and the Governor’s office were aware of our concerns. We raised these concerns both publicly while testifying on the potential impact of this bill and privately. We respect that they saw the issue differently and will work with them moving forward to find the necessary revenue to meet these mandates so that the retirements for Chicago’s first responders are secured.”

Supporters defend the bill

The bill was sponsored by Northwest Side Democratic State Senator Robert Martwick, who says the bill was needed to bring tier 2 Chicago police and fire employees, or those hired after 2011, in line with their colleagues across the state.

“What we did was provide the same retirement parity, the same Tier 2 fix, for Chicago police and fire that was granted six years prior to every police and fire employee across the state of Illinois,” Martwick said.

He also says the bill was necessary to satisfy an IRS rule called “Safe Harbor,” where government employees must receive benefits equal to or greater than social security. Berg says the bill doesn’t actually accomplish that, while adding billions to the city’s obligations.

“That is a total red herring to say that this has anything to do with the Safe Harbor ruling, and the city knows that,” Berg said.

Long-term financial fallout

Martwick says he understands the financial ramifications, but says that a fix would be more expensive down the road without the current legislation.

“The problems that have been created by previous administrations are there. Passing the law doesn’t make the funds more insolvent, it just makes them more apparent and readily accessible,” Martwick said.

The Source: Details for this story were provided by documents obtained exclusively by Fox 32 political editor Paris Schutz.